Page 25 - 108業務簡介_英文版

P. 25

Bureau of Labor Insurance, Ministry of Labor Brief Introduction

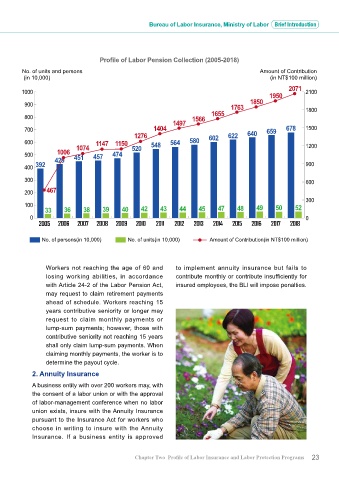

Profile of Labor Pension Collection (2005-2018)

No. of units and persons Amount of Contribution

(in 10,000) (in NT$100 million)

2071

1000 1950 2100

900 1763 1850

1655 1800

800 1566

1497

700 1404 659 678 1500

1276 602 622 640

600 1074 1147 1150 520 548 564 580 1200

1006

500 429 451 457 474

400 392 900

300 600

200 467

300

100 49 50 52

33 36 38 39 40 42 43 44 45 47 48

0 0

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

No. of persons(in 10,000) No. of units(in 10,000) Amount of Contribution(in NT$100 million)

Workers not reaching the age of 60 and to implement annuity insurance but fails to

losing working abilities, in accordance contribute monthly or contribute insufficiently for

with Article 24-2 of the Labor Pension Act, insured employees, the BLI will impose penalties.

may request to claim retirement payments

ahead of schedule. Workers reaching 15

years contributive seniority or longer may

request to claim monthly payments or

lump-sum payments; however, those with

contributive seniority not reaching 15 years

shall only claim lump-sum payments. When

claiming monthly payments, the worker is to

determine the payout cycle.

2. Annuity Insurance

A business entity with over 200 workers may, with

the consent of a labor union or with the approval

of labor-management conference when no labor

union exists, insure with the Annuity Insurance

pursuant to the Insurance Act for workers who

choose in writing to insure with the Annuity

Insurance. If a business entity is approved

Chapter Two Profile of Labor Insurance and Labor Protection Programs 23