Page 20 - 109業務簡介_ENLISH

P. 20

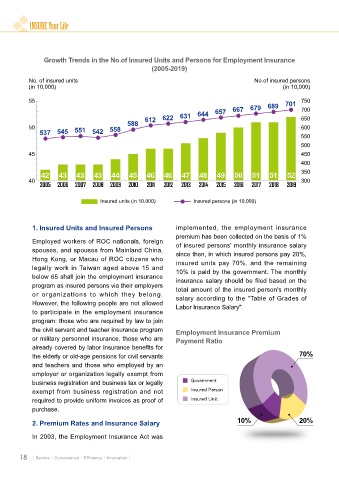

Growth Trends in the No.of Insured Units and Persons for Employment Insurance

(2005-2019)

No. of insured units No.of insured persons

(in 10,000) (in 10,000)

55 657 667 679 689 701 750

700

588 612 622 631 644 650

50 551 558 600

537 545 542 550

500

45 450

400

42 43 43 43 44 45 46 46 47 48 49 50 51 51 52 350

40 300

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

Insured units (in 10,000) Insured persons (in 10,000)

1. Insured Units and Insured Persons implemented, the employment insurance

premium has been collected on the basis of 1%

Employed workers of ROC nationals, foreign of insured persons' monthly insurance salary

spouses, and spouses from Mainland China, since then, in which insured persons pay 20%,

Hong Kong, or Macau of ROC citizens who insured units pay 70%, and the remaining

legally work in Taiwan aged above 15 and 10% is paid by the government. The monthly

below 65 shall join the employment insurance insurance salary should be filed based on the

program as insured persons via their employers total amount of the insured person's monthly

or organizations to which they belong. salary according to the "Table of Grades of

However, the following people are not allowed Labor Insurance Salary".

to participate in the employment insurance

program: those who are required by law to join

the civil servant and teacher insurance program Employment Insurance Premium

or military personnel insurance, those who are Payment Ratio

already covered by labor insurance benefits for

the elderly or old-age pensions for civil servants 70%

and teachers and those who employed by an

employer or organization legally exempt from

business registration and business tax or legally Government

exempt from business registration and not Insured Person

required to provide uniform invoices as proof of Insured Unit

purchase.

2. Premium Rates and Insurance Salary 10% 20%

In 2003, the Employment Insurance Act was

18 │Service‧Convenience‧Efficiency‧Innovation│